Seeking your donations of outdoor work and office wear

Dress to Impress is seeking mild & cold weather outdoor work wear and office wear in all sizes, styles and for all genders. Clothing is accessed by local job seekers for interviews and for the first weeks on the job. With the support of the community-at-large and via the GNWT Anti-poverty fund, Dress to Impress supported 71 individuals working for 21 employers in 2018-2019.

Dress to Impress provides jobseekers with professional clothing to wear to upcoming job interviews and the first weeks on the job. Its single aim is to reduce the initial costs to those who are beginning employment.

How can you help

Dress to Impress is seeking warm & cold weather outdoor work wear and office wear in all sizes, styles and for all genders. Items in high demand include;

- safety work boots, coats, and overalls (both mild and cold weather gear);

- office wear (pants, shirts, sweaters, blouses etc.) including accessories (belts, shoes, etc.)

Donated clothing should be gently worn, appropriate, in good condition, contemporary and clean. Consider items that are permanent press, washable and do not require dry cleaning.

Any clothing received and not used by Dress to Impress will be donated to local charities.

Drop off location

- NWT Career Centre – Suite 102, 5204 – 50th Avenue (Diamond Plaza)

For more information, contact (867) 873-8790 or email career@cdetno.com

CDÉTNO announces the hiring of its new Communication and Marketing Officer

Yellowknife, February 05, 2019 – CDETNO is pleased to announce the hiring of Miss Carine Ouedraogo as Communications and Marketing Officer.

National Francophone Immigration Week

From November 4–10, 2018, Canada will celebrate National Francophone Immigration Week, an initiative by the Fédération des communautés francophones et acadiennes (FCFA). To mark the occasion, Conseil de développement économique des Territoires du Nord-Ouest (CDETNO) and the Department of Industry, Tourism and Investment (ITI) is honouring four Francophone immigrants who chose the Northwest Territories as their new home.

Destination Canada Job Fair

CDETNO will attend for the 12th time Destination Canada Job Fair, in Paris and Brussels, from November 13th to 17th.

Three CDETNO’s employees will promote employment opportunities and the lifestyle in the Northwest Territories to hundreds of European jobs seekers. The forum will also allow candidates to obtain all relevant information on economic immigration, life in Canada and immigration support programs.

We invite interested employers to advertise their job offers during Destination Canada, to contact Valérie Gosselin, Immigration, Recruitment and Career Officer.

Recruit at the Employment Café, on October 24th, 2018

Do you have positions to fill in your organization? Come recruit at our Employment Café on October 24th, 2018, from 5 to 7 pm at the Greenstone Building.

Meet with job seekers in a professional but relaxed atmosphere. Book your table by contacting Gordon Ross, NWT Career Centre Officer. It’s free for everyone!

Funded by IRCC and in partnership with Edge and the Yellowknife Chamber of Commerce.

Financial Statements

You can consult CDETNO’s 2017-2018 Financial Statements by clicking here (in French only).

AGM and 15th Anniversary

You are cordially invited to our General Annual Meeting and to our 15th Anniversary celebrations on September 25th, 2018, at 5:30 PM at the Explorer Hotel.

On this special occasion, we will bring together our members, partners, officials and the community for an evening of celebrations.

Sponsorship opportunity: CDETNO 15th Anniversary

CDETNO AGM and 15th Anniversary celebrations will be held on September 25th, 2018, from 5:30 pm at the Explorer Hotel.

To make this event a success, we need your support. Read our sponsorship package here!

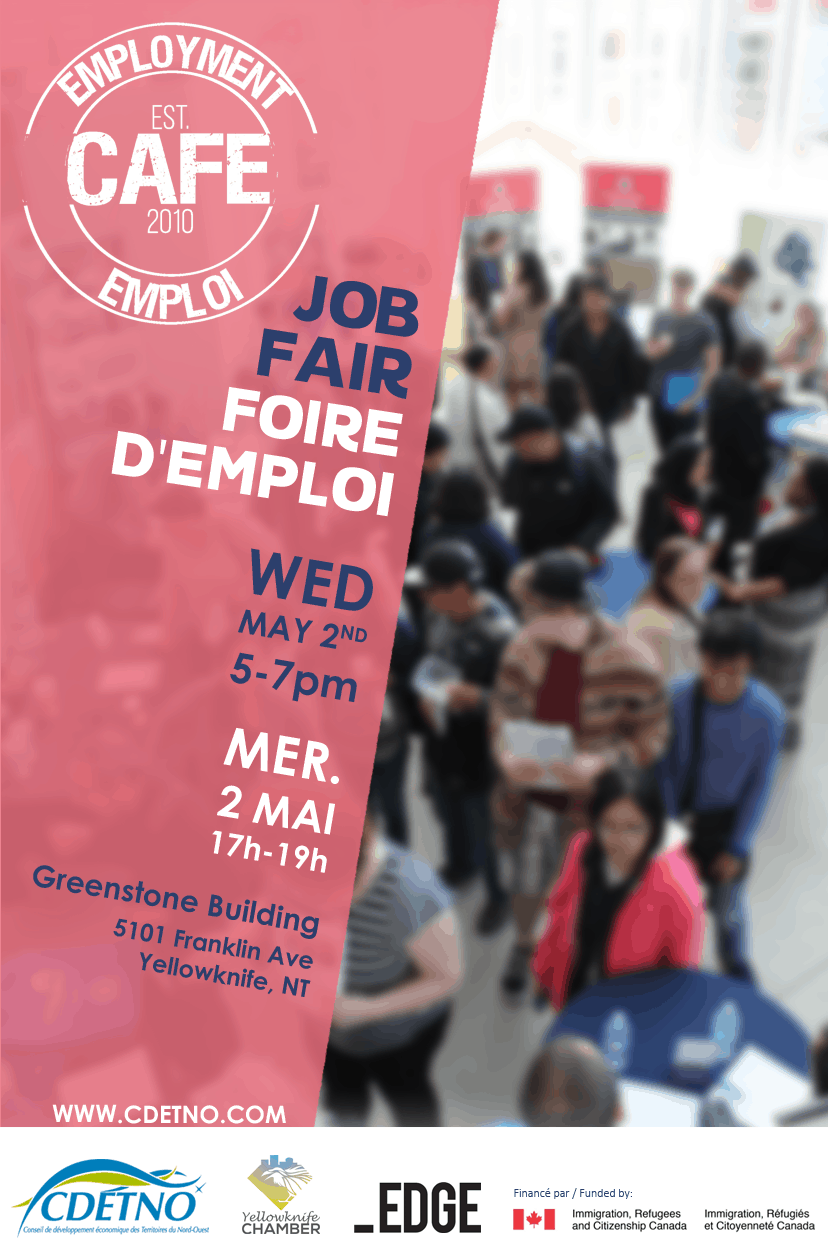

Employment Cafe in Yellowknife on May 2nd, 2018

Looking for a job? Come with your Resume and your best smile to network in a professional but relaxed atmosphere!

Join us on May 2nd, from 5 PM to 7 PM, at the Greenstone Building.